Navigating the 2024 Loan Landscape: FHA, VA, Conventional, and USDA Loan Limit Updates

Original Source: saleztrax.com

As we step into the new year, changes in loan limits that promise to reshape the lending landscape. The Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), conventional loan programs, and the U.S. Department of Agriculture (USDA) are all adjusting their limits for 2024. Here's a comprehensive breakdown of the latest developments:

FHA Loan Limits 2024

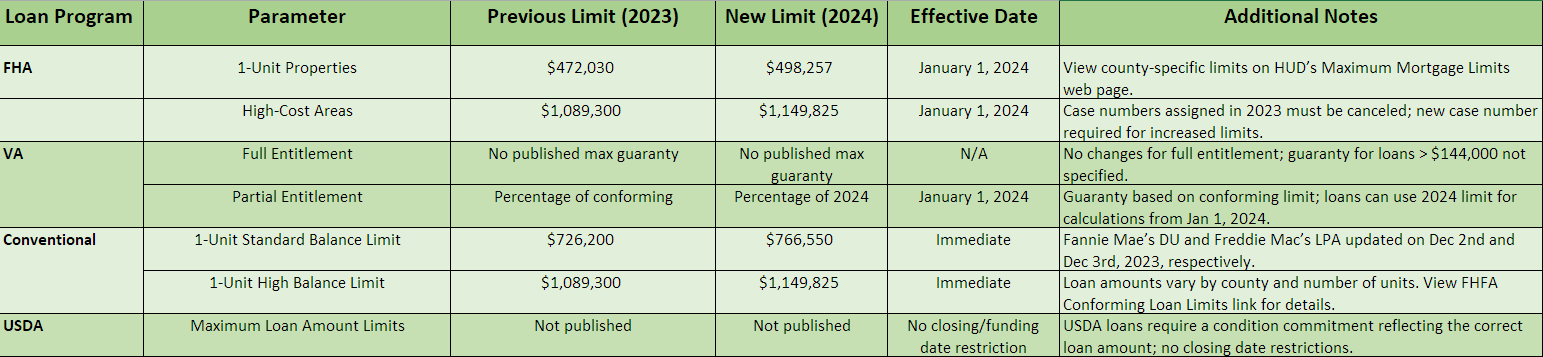

The FHA recently unveiled its revised loan limits, slated to take effect for case numbers assigned on or after January 1, 2024. This adjustment impacts nearly every county in the U.S., with increases in both standard and high-cost areas.

1-Unit Properties: The limit for 1-unit properties is set to rise from $472,030 to $498,257.

High-Cost Areas: Regions classified as high-cost will see a significant increase, from $1,089,300 to $1,149,825.

To leverage these new limits, it's crucial to note that the FHA case number must be assigned on or after January 1, 2024. The earliest closing/funding date using the 2024 limits will be in January 2024. For a detailed breakdown by county, interested parties can refer to HUD’s Maximum Mortgage Limits web page.

Important for 2023 FHA applicants: Case numbers assigned before January 1, 2024, need to be canceled, necessitating the assignment of a new case number on or after January 1, 2024 to access the increased limits.

VA Loan Limits 2024

Full Entitlement

For Veterans with full entitlement, the VA does not publish a maximum guaranty amount for loans exceeding $144,000.

Partial Entitlement

Maximum Guaranty: Veterans with partial entitlement will see a maximum guaranty as a percentage of the conforming loan limit, set at $766,550 for 2024.

Effective Date: To use the 2024 limits, the closing date must be on or after January 1, 2024.

Location-Based Limits: For properties in counties with differing loan limits, VA's maximum guaranty for veterans with partial entitlement aligns with the 2024 conforming one-unit county loan limit where the property is situated.

Conventional Loan Limit Increase for 2024

Aligning with Fannie Mae and Freddie Mac's conforming loan limit increases, conventional loan programs are undergoing changes.

1-Unit Standard Balance Limit: This limit rises from $726,200 to $766,550.

1-Unit High Balance Limit: High balance limits see an increase from $1,089,300 to $1,149,825.

Loan amounts continue to vary by county and number of units. Fannie Mae's Desktop Underwriter (DU) and Freddie Mac's Loan Product Advisor (LPA) will be updated to reflect the new 2024 limits on December 2nd and December 3rd, respectively.

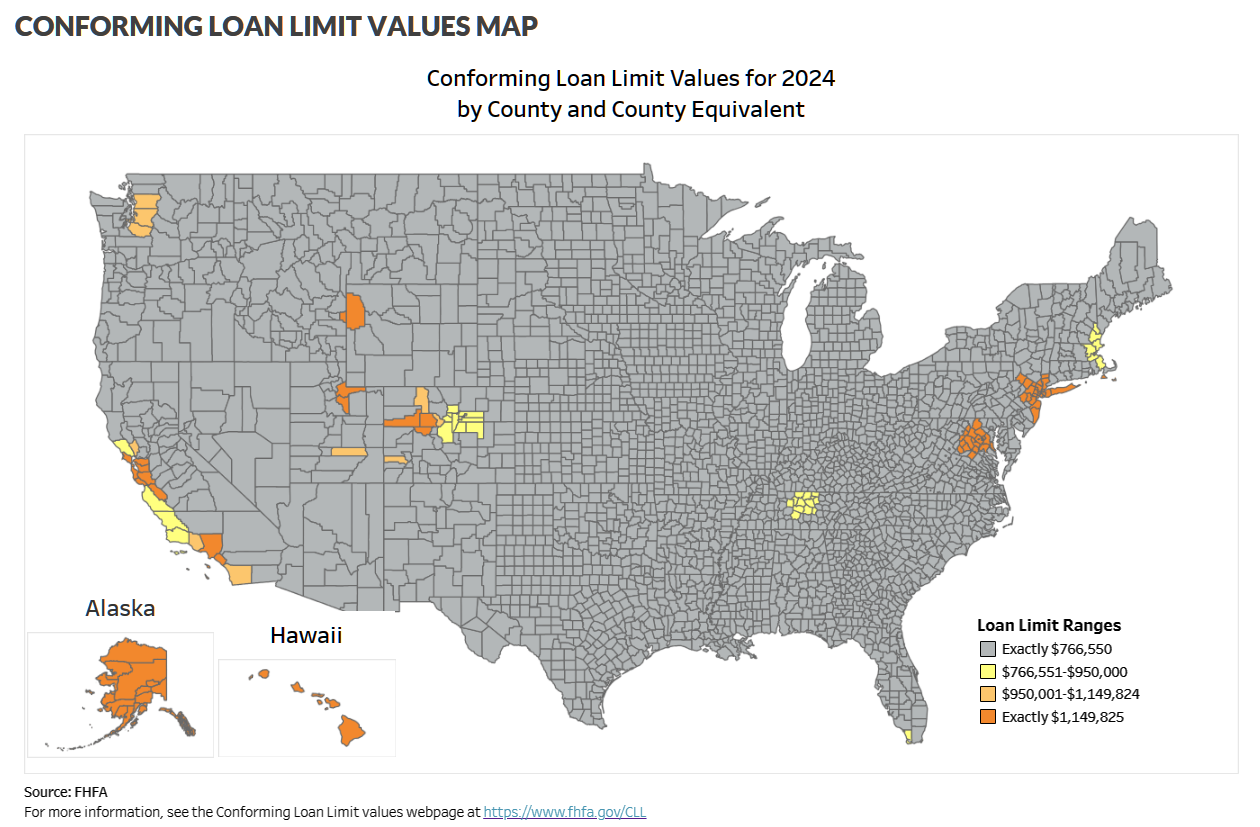

For a detailed breakdown of 2024 loan limits by county and unit, refer to the

FHFA Conforming Loan Limits link.

USDA Loan Limits 2024

In the realm of home financing, the U.S. Department of Agriculture (USDA) stands out with its unique approach to loan limits in 2024.

No Published Maximum Loan Amount Limits: Unlike other loan programs, USDA does not publish specific maximum loan amount limits. Instead, USDA loans require a condition commitment that accurately reflects the intended loan amount for the process to move forward.

No Closing/Funding Date Restriction: A notable distinction of USDA loans is the absence of closing or funding date restrictions. With no imposed maximum loan amount limit, borrowers benefit from greater flexibility in choosing their closing dates, making USDA loans an attractive option for those seeking a more adaptable financing solution.

As potential homebuyers explore their financing options, the USDA's approach offers a refreshing departure from the constraints associated with other loan programs. The absence of specific limits and date restrictions provides borrowers with the freedom to navigate the homebuying process with greater ease and flexibility.

In the dynamic landscape of real estate financing for 2024, the FHA, VA, conventional, and USDA updates serve as a reminder of the diverse options available to homebuyers, each with its own set of advantages and considerations. As we navigate the evolving terrain of housing finance, understanding the nuances of each loan program becomes paramount in making informed decisions for a successful homebuying journey.

Subscribe to our blog and stay up to date about changes in the market that effect buyers. Or contact us to learn more about mortgage processing services.

Quick Contact Form

Equal Housing Lender

Footer Contact Form

We will get back to you as soon as possible.

Please try again later.

The mission of Saleztrax Mortgage Processing is to expertly provide a positive and expedient mortgage financing experience in a secure digital environment.

All Rights Reserved | Saleztrax Mortgage Processing

Licensed in Florida 197908

Connecticut NMLS 205506

Delaware NMLS 197908

Georgia NMLS 205506

Pennsylvania NMLS 205506

Licensing in other States upon request